Medical bills are a common source of stress for many Americans. Dealing with the cost of healthcare can be challenging, and when medical bills end up in collections, the stress can escalate even further.

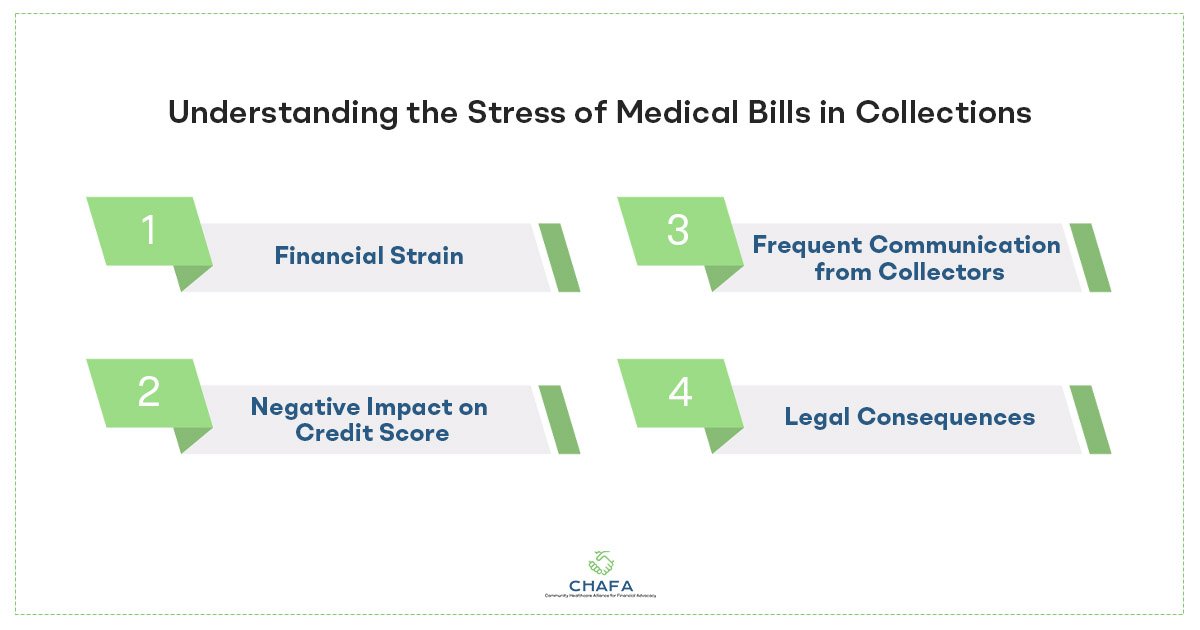

Understanding the Stress of Medical Bills in Collections

Medical bills in collections can be a significant source of stress for individuals and families.

Understanding why they cause such anxiety is crucial for addressing the issue effectively. Medical bills assistance is a huge relief for individuals.

- Financial Strain:

When medical expenses go unpaid and end up in collections, it can put a significant strain on your finances. These debts can accumulate interest and fees over time, making the initial commitment much more difficult to repay. The stress of rising debt tends to have a negative impact on one’s mental and emotional health. This is why medical bills financial assistance is extremely important.

- Negative Impact on Credit Score:

One of the most major concerns is the negative impact on your credit score. A lower credit score will influence your ability to obtain loans, mortgages, or credit cards, as well as your career prospects. The dread of damaging your credit can be a major source of anxiety.

- Frequent Communication from Collectors:

When a medical bill is in collections, collection agencies will contact you constantly. They may utilize aggressive debt collection practices, which can be intimidating and distressing. This persistent stress can exacerbate emotions of worry and tension.

- Legal Consequences:

Medical bills in collections, if not addressed, could end up in serious legal action. Wage garnishment and other legal measures might ensue, compounding your financial and mental difficulties.

Why Is It Important to Take Action?

Dealing with medical bills in collections is not something you can afford to ignore. Taking timely action is crucial for several reasons:

- Protect and prevent damage to your credit score.

- Avoid the stress and financial ramifications associated with legal actions.

- Taking action empowers you to regain control of your financial situation.

- By taking action, you can ease the emotional burden and reduce stress.

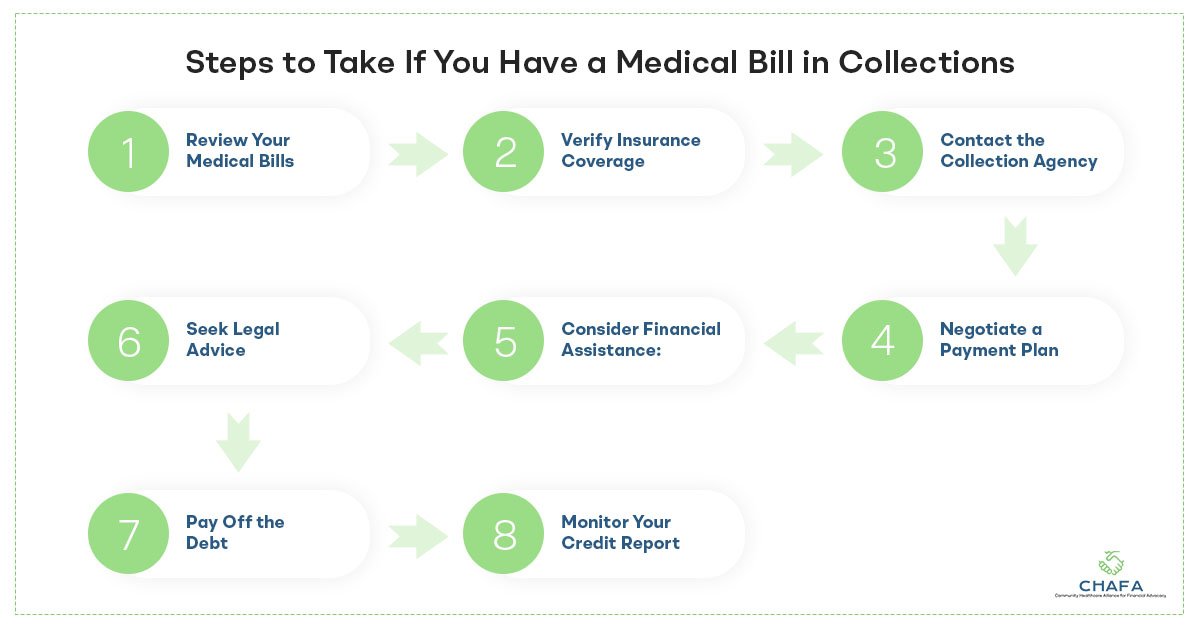

Steps to Take If You Have a Medical Bill in Collections

Now that we understand the stress and importance of addressing medical bills in collections, let’s explore the specific steps you should take to navigate this challenging situation.

1) Review Your Medical Bills:

The first step is to thoroughly investigate the medical expenses at issue. Keep your clinical documentation ready and in hand. Check that they are correct and that you completely comprehend the prices. Examine the document for any potential flaws or contradictions. If you discover any errors, contact your healthcare practitioner to get them corrected. This is where the experts at CHAFA, known for medical bills advocacy services, an assist you tremendously.

2) Verify Insurance Coverage:

If you have health insurance, make sure that the medical treatments you get are properly billed to your insurance company. Check to see if your insurance company has processed the claims and paid their portion. Any outstanding balance should be discussed with the healthcare provider before it is turned over to collections.

3) Contact the Collection Agency:

If a collection agency has already been assigned to your medical debt, contact them as soon as possible. Discuss the debt and get documented confirmation of the debt. This will help you in verifying the claim’s authenticity.

4) Negotiate a Payment Plan:

Once you’ve confirmed the debt, reach out to the collection agency to work out a payment plan that works for you. They could be willing to take a smaller payment or provide you with a more reasonable payment plan. Make sure that all agreements are in writing to avoid any misunderstandings.

5) Consider Financial Assistance:

Individuals who are unable to pay their medical costs may be eligible for financial aid or charity care programs from certain healthcare providers. These programs tend to be dictated by your income and financial circumstances. Inquire with your healthcare practitioner to learn more about such possibilities.

6) Seek Legal Advice:

Consider getting legal assistance from a medical bills attorney if you believe you are being unlawfully pursued for a debt or if you are facing legal action from a collection agency. A debt and collection attorney can help you manage the problem and defend your rights.

7) Pay Off the Debt:

Pay off the debt in full if possible. While this may not always be achievable, paying your medical bills will help you clear your financial commitments while also improving your credit score over time. If you get help or reach a settlement, make certain that all agreements are followed.

8) Monitor Your Credit Report:

Monitor your credit report on a regular basis to confirm that the medical bill in collections has been properly documented and updated. If you find errors on your credit report, file a dispute with the credit bureaus instantly.

Ways to Prevent Medical Bills from Going to Collections

Preventing medical bills from going to collections is the best approach to avoid the associated stress and financial difficulties.

Here are some strategies to help you prevent future medical bills from ending up in collections:

- Familiarize yourself with your health insurance policy and its coverage details. Knowing what services are covered, the co-pays, deductibles, and out-of-pocket maximums can help you make informed decisions about your healthcare.

- When seeking medical care, try to use in-network healthcare providers as they are usually covered more comprehensively by your insurance, reducing your out-of-pocket expenses.

- Before undergoing any medical procedures, ask for cost estimates from your healthcare provider. This will help you anticipate the expenses and plan your finances in advance.

- Having an emergency fund to cover unexpected medical expenses can prevent you from falling behind on bills and ending up in collections.

- If you are unable to pay a medical bill in full, discuss payment plans with your healthcare provider before it goes to collections.

- Inquire about financial assistance or charity care programs provided by your healthcare institution.

- Depending on your financial situation, you may qualify for government assistance programs like Medicaid or CHIP, which can help cover healthcare costs.

- Keep yourself informed about changes in your healthcare coverage and insurance policy.

- After receiving medical services, review your medical bills thoroughly. Ensure that the charges are apt, and check for any errors. Address any discrepancies promptly to prevent billing issues down the line.

While dealing with medical bills in collections is a stressful and challenging situation, CHAFA can help you take necessary action. We understand the stress associated with medical bills in collections and recognize the importance of addressing them.

Remember that you are not alone in this journey, and seeking assistance and guidance when needed is a sign of responsibility.