Managing medical bills can be a difficult and intimidating undertaking for a lot of individuals. Understanding the payment process and identifying strategies to reduce the financial load is critical in light of escalating healthcare prices and complex billing systems.

This step-by-step guide is intended to provide useful insights and practical recommendations to assist you in navigating the world of medical billing and making informed decisions about paying your medical bills.

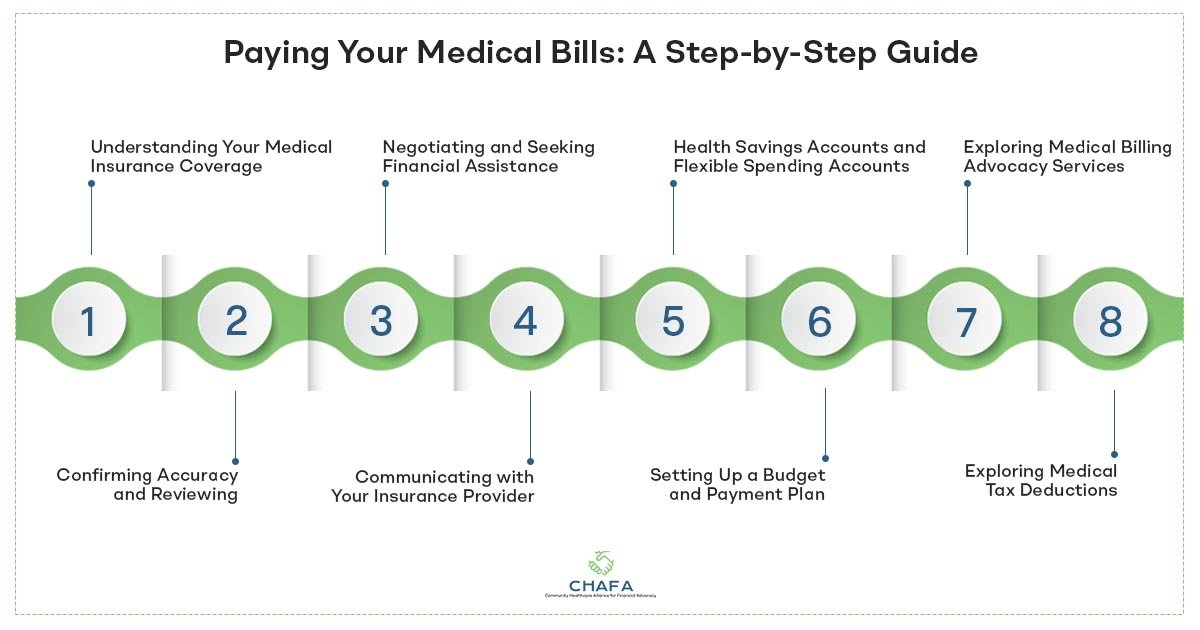

1) Understanding Your Medical Insurance Coverage:

Before you begin the payment process, it is important that you are familiar with your health insurance coverage. Examine your insurance policy to learn about the sort of policy you have, the degree of coverage, deductible amounts, copayments, and any exclusions or limitations.

Knowing your insurance coverage will assist you in budgeting for medical bills and also protect you from any medical billing frauds.

2) Confirming Accuracy and Reviewing Your Medical Bills:

You will most likely receive an explanation of benefits (EOB) from your insurance company and an invoice from the healthcare provider after receiving medical services. Examine these records for accuracy, confirming that the services described correspond to those you got. Keep an eye out for any billing issues or irregularities, such as duplicate charges or erroneous insurance information.

If you find any inaccuracies, contact your insurance company or the billing department of the healthcare provider to have them corrected. Having a medical bill advocate also makes a significant difference when it comes to navigating medical bill discrepancies.

3) Negotiating and Seeking Financial Assistance:

If you are faced with major medical bills that are beyond your means, it is important to investigate opportunities for negotiation or financial assistance. Contact your healthcare provider’s billing department to learn about possible payment plans, reductions, or hardship programs.

Inquire about any local or national resources that may be available, such as government assistance programs or charitable organizations that may provide medical bills assistance.

4) Communicating with Your Insurance Provider:

When your insurance provider rejects coverage for specific medical procedures, it is important that you understand and educate yourself on why. If you believe the denial was unwarranted, contact your insurance provider for clarification and gather all essential evidence to launch an appeal.

Keep detailed records of your conversations, including the names of the representatives you speak with and any reference numbers offered.

5) Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs):

Health savings accounts (HSAs) and flexible spending accounts (FSAs) are effective tools for saving money for medical bills on a pre-tax basis. If you have access to these accounts, consider making monthly contributions to them to accumulate funds that can be used to pay for medical expenditures.

To make the most of these tax-advantaged options, get familiar with the qualifying criteria, contribution limitations, and guidelines related to HSAs and FSAs.

6) Setting Up a Budget and Payment Plan:

Create a budget and payment plan that corresponds with your financial capabilities to efficiently manage your medical expenditures. Consider your income, normal costs, and outstanding medical bills. Prioritize your payments based on urgency, and if necessary, arrange affordable installment plans.

You can prevent bills from piling up and minimize the impact on your finances by budgeting ahead of time and making consistent payments.

7) Exploring Medical Billing Advocacy Services:

Consider engaging with a medical billing advocate if you find the medical billing process daunting or if you require expert assistance. These experts specialize in navigating the complexity of medical bills, negotiating with healthcare providers and insurance companies on your behalf, and assisting you in understanding your patient rights.

Find competent professionals that can assist you in managing your medical costs by researching local advocacy services or consulting online resources. This is where CHAFAhelps comes into play, offering you a team of legal medical experts.

8) Exploring Medical Tax Deductions and Assistance Programs:

Be mindful of potential tax breaks for medical spending. You may be eligible to deduct qualified medical expenses that exceed a set percentage of your adjusted gross income (AGI) depending on your circumstances. For more information, consult a tax professional or the Internal Revenue Service (IRS) guidelines. Additionally, if you meet the eligibility requirements, look into government assistance programs such as Medicaid or the Children’s Health Insurance Programme (CHIP).

Even after you have paid your medical expenses, it remains important to be watchful and monitor your medical bills on a regular basis. Keep track of payments, seek and keep receipts, and compare them to insurance statements. If you detect any anomalies, contact your healthcare provider or insurance company right away. You can also reach out to a medical bill advocate during such circumstances.

CHAFA is your trusted partner when it comes to managing medical bills and advocacy. Having been in the healthcare industry for over 27 years, helps you effectively review and resolve erroneous medical bills.