Heart attacks are a common and expensive health issue in the United States. They have an impact not just on the affected person’s health but also on their finances. Understanding the financial effects of heart attacks is essential as it can help people make educated decisions regarding prevention and treatment.

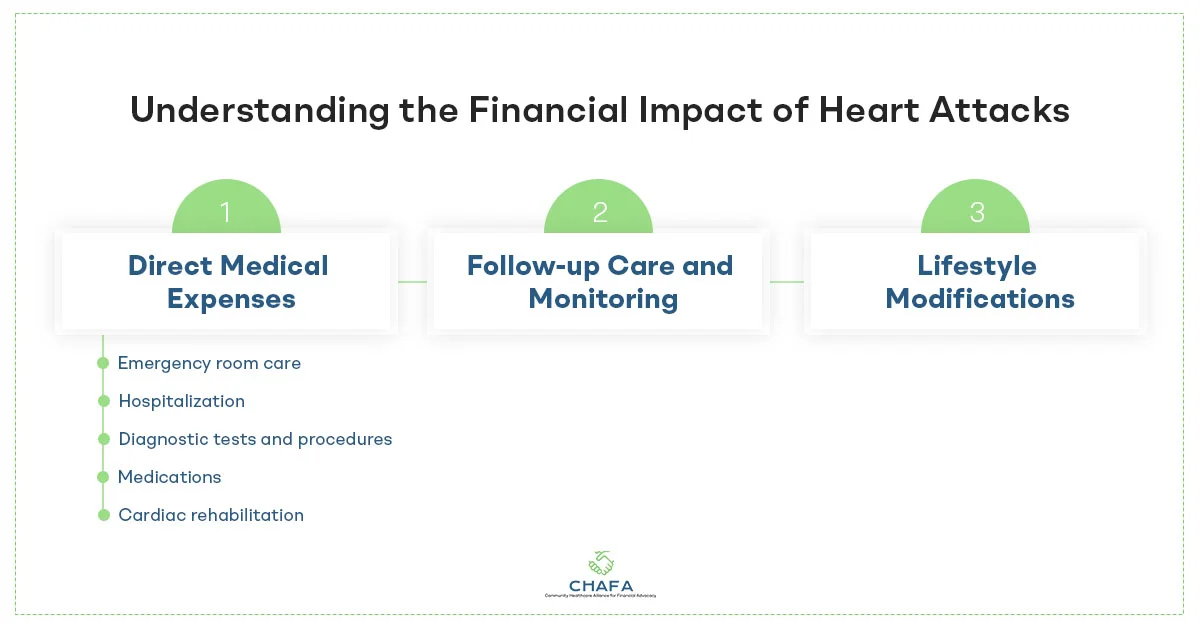

Understanding the Financial Impact of Heart Attacks

A heart attack, also known as a myocardial infarction, is a potentially fatal condition in which the blood supply to the heart is substantially decreased or blocked. It is a major health hazard, but it also has a big financial impact.

Let us examine the major aspects that influence the financial impact of heart attacks:

- Direct Medical Expenses

- Emergency room care: The emergency room (ER) usually serves as the first line of

contact for a heart attack patient. The costs of ER care can be significant, especially if

additional testing and procedures are required. - Hospitalization: Patients are often admitted to the hospital after the initial evaluation to undergo

further treatment, observation, or perhaps even surgery. Hospitalization charges account for a

sizable portion of their total healthcare expenditures. - Diagnostic tests and procedures: To assess and treat the illness, various tests and procedures such

as electrocardiograms (ECGs or EKGs), blood tests, cardiac catheterization, and angioplasty may be

performed. These tests tend to add to the financial strain. - Medications: Heart attack patients often require multiple medications, including antiplatelet drugs,

beta-blockers, and statins. These medications can be expensive and need to be taken for an extended

period. - Cardiac rehabilitation: After a heart attack, cardiac rehabilitation programs are recommended to

improve the patient’s overall health and reduce the risk of future heart problems. These programs

have their own associated costs.

- Emergency room care: The emergency room (ER) usually serves as the first line of

- Follow-up Care and Monitoring

The financial toll of a heart attack does not end with hospitalization. Patients require ongoing medical care and monitoring, including follow-up appointments, further tests, and medication renewals based on their clinical documentation. These expenses can add up over time.

- Lifestyle Modifications

Patients who have suffered from a heart attack are usually advised to make considerable lifestyle adjustments. This could involve eating a healthy diet, exercising regularly, and stopping smoking. While these modifications may improve long-term health, they may necessitate additional costs such as gym subscriptions or dietary supplements.

Preventive Measures and Indirect Costs

Preventing heart attacks is not only a matter of health but also a significant financial concern. Indirect costs, such as lost productivity and the emotional toll on patients and their families, can be substantial.

Lifestyle Modifications and Preventive Care

Productivity Loss

- Adopting a heart-healthy diet and incorporating regular physical activity into one’s routine can reduce the

risk of heart attacks. - Smoking is a major risk factor for heart disease.

- Preventive care, including regular check-ups and screenings, can help identify and manage risk factors

before they lead to a heart attack.

Productivity Loss

The financial consequences of a heart attack include secondary costs related to productivity. Individuals who have heart attacks often need time away from work for recuperation and medical appointments.

They may be unable to return to their prior level of production in certain circumstances, resulting in revenue loss.

Emotional and Psychological Costs

A heart attack can also have major emotional and psychological implications. Stress and anxiety caused by a cardiac event can have long-term implications on mental health, necessitating therapy or counseling and adding to the overall financial burden.

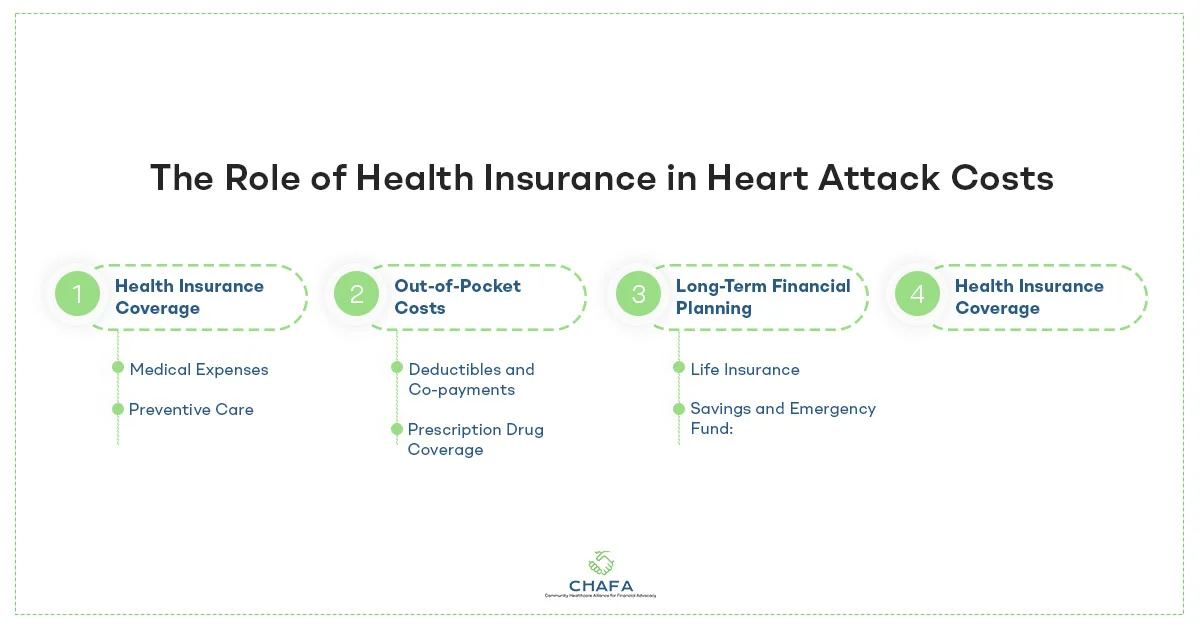

The Role of Health Insurance in Heart Attack Costs

Health insurance plays a pivotal role in managing the financial impact of a heart attack. Understanding how health insurance works in this context is essential for individuals and families to plan for and navigate financial challenges.

While understanding the complexities of health insurance can be overwhelming, the medical advocates at CHAFA help you understand it better.

- Health Insurance Coverage

- Expenses: Most health insurance policies cover the direct medical costs of a heart attack, such as hospitalization, diagnostic testing, and medications. However, depending on the type of insurance plan and the individual’s policy, specific coverage and out-of-pocket payments could vary.

- Preventive Care: Preventive care, such as cholesterol screenings and blood pressure checks, are also covered by many health insurance policies. Utilizing these services can help individuals identify and manage risk factors prior to a heart attack.

- Out-of-Pocket Costs

- Deductibles and Co-payments: Patients who have had a heart attack might continue to incur out-of-pocket expenses such as deductibles and co-payments. Understanding the specifics of one’s health insurance plan is essential for anticipating and managing these costs.

- Prescription Drug Coverage: Certain prescription medications recommended following a heart attack could be underinsured. Patients should verify their insurance coverage and look for cost-cutting options, such as generic medication alternatives.

- Long-Term Financial Planning

- Life Insurance: Some people get life insurance policies to provide financial support to their loved ones in the event that they die. A life insurance policy can help reduce the financial effects of a heart attack.

- Savings and Emergency Funds: Building a strong savings account or emergency fund can help cover unexpected medical expenses and lost income due to a heart attack.

- Legal Protections

Patients have legal protections and rights when it comes to their health insurance coverage. Understanding these rights and appealing insurance denials if necessary can help ensure that patients receive the coverage they are entitled to. The medical bills advocacy services offered by CHAFA counter any legal implications that may arise given the event of a medical emergency. They guide you with paying your medical bills faultlessly.

Individuals can better prepare for the possible financial expenditures connected with this life-threatening condition by taking proactive actions to maintain heart health and being aware of their insurance alternatives. Remember that investing in your heart’s health is an investment in both your physical and financial well-being.

Connect with CHAFA to learn more about healthcare expenses.