Medical emergencies can occur at any time, and dealing with the aftermath can be difficult enough without the extra stress of unexpected medical expenditures. These unexpected costs, often known as surprise medical bills or balance billing, can leave people with excessive fees for healthcare procedures they thought were covered by their insurance.

The No Surprises Act was enacted by the United States government in response to growing concerns about unexpected medical expenditures.

Understanding Surprise Medical Bills:

Surprise medical bills arise when patients are charged unexpectedly for out-of-network healthcare services while receiving treatment at an in-network clinic. This can happen in various situations, including emergency room visits, where patients have limited influence over the physicians participating in their care.

In other cases, patients may choose an in-network institution on purpose, only to realize afterward that some clinicians involved, such as anesthesiologists or radiologists, were not in-network. Out-of-network doctors can bill consumers directly for the difference between their charges and what the insurance company considers appropriate, resulting in dramatically higher expenses.

The Need for Legislative Intervention:

Overbilling in healthcare has become a frequent issue in the United States, leaving many people with significant medical debts. These costs can have serious financial ramifications, resulting in medical bankruptcies and limiting individuals’ access to vital healthcare.

The healthcare system’s complexity, along with a lack of openness regarding network coverage and provider billing practices, has made it difficult for patients to navigate the terrain and avoid surprise bills. Recognizing the critical need for protection against unexpected medical expenditures, the United States government enacted the No Surprises Act. Additionally, you can acquire assistance for medical billing and coding services as well.

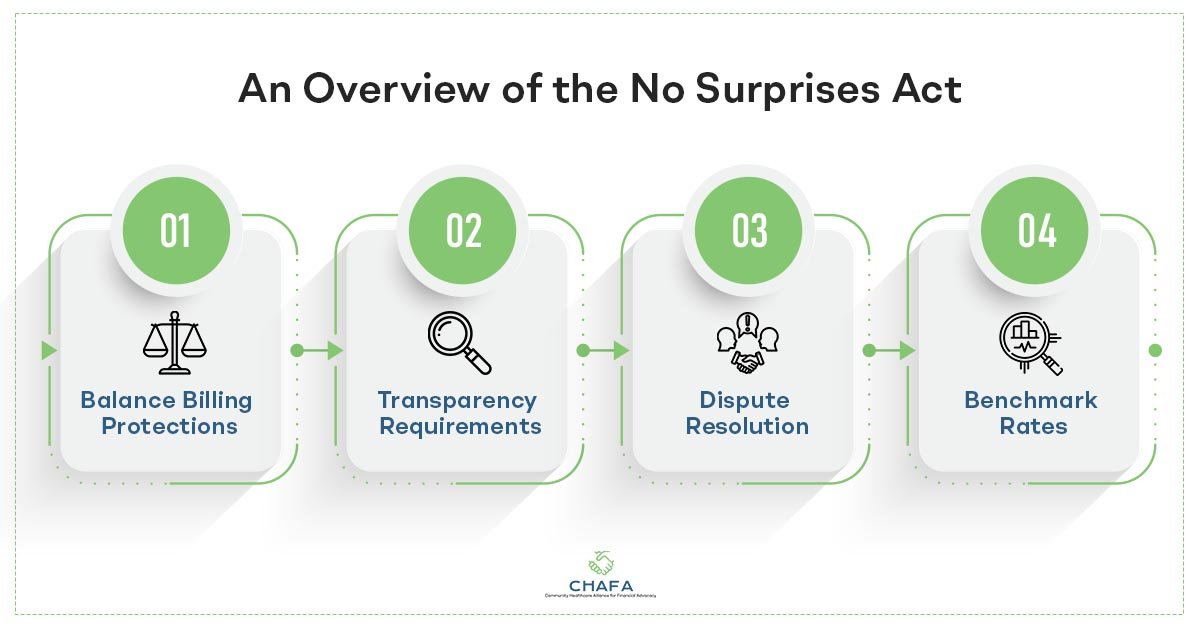

An Overview of the No Surprises Act:

The No Surprises Act, which was signed into law as part of the Consolidated Appropriations Act, of 2021, intends to shield people from unexpected medical expenses and to establish a fair dispute resolution mechanism for insurance and providers.

Here are some key points to understand about the No Surprises Act:

1) Balance Billing Protections:

Balance billing is prohibited in some circumstances, including emergency services, non-emergency services performed in an in-network facility by an out-of-network provider, and air ambulance services. In these cases, patients cannot be charged more than their in-network cost-sharing amounts.

2) Transparency Requirements:

Insurers and providers must make their network coverage and price information more transparent. They must keep up-to-date directories of in-network providers and, upon request, reveal the projected prices of treatments to patients.

3) Independent Dispute Resolution:

To address conflicts between insurers and providers, the Act provides an Independent Dispute Resolution (IDR) process. If they are unable to reach an agreement on the price to be paid for an out-of-network service, they can refer the matter to an impartial court, which will assess the evidence and render a binding judgment.

4) Benchmark Rates:

When the IDR method is used, the arbitrator will evaluate numerous factors, including the median in-network rate, to decide the amount of payment. This benchmark rate tries to establish a reasonable balance between provider fees and payment responsibilities for insurers.

How Does This Act Impact Everyone?

The No Surprises Act brings significant changes that impact all stakeholders in the healthcare system:

1) Patients:

The Act protects patients from unexpected medical expenditures by providing important safeguards. It ensures that individuals are solely liable for their in-network cost-sharing amounts, giving financial comfort as well as peace of mind.

2) Healthcare Providers:

Healthcare professionals, particularly those who are not in a network are impacted significantly. To prevent balancing charging patients in protected situations, providers must ensure that their billing practices comply with the new standards. The IDR procedure establishes a fair mechanism for addressing payment disputes, thereby leveling the playing field for suppliers.

3) Insurers:

Insurers are responsible for executing the transparency standards and keeping provider directories accurate and up to date. The benchmark prices created through the IDR process may have an impact on insurers’ reimbursement rates, perhaps resulting in changes to their payment arrangements.

Protecting Yourself from Surprise Medical Bills:

While the No Surprises Act provides essential protections, it is still important for individuals to take proactive steps to safeguard themselves from surprise medical bills:

- Get acquainted with your insurance policy’s terms and conditions, including the network of providers covered and any exclusions or limitations.

- Before undergoing any medical procedure, call your insurance company and the medical center to establish the provider’s network status and gather cost estimates.

- Choose in-network healthcare providers and facilities wherever possible to reduce the risk of unexpected medical expenditures. You must also ensure that all physicians involved in your care, such as anesthesiologists and radiologists, are all in-network.

- Stay updated on any changes to your insurance coverage, including provider network modifications.

- File an appeal with your insurance company if you get a surprise medical bill that you believe violates the No Surprises Act.

Medical Bill Advocacy:

Medical billing advocates are legal experts who assist patients in understanding and managing their medical bills. They help people comprehend insurance claims and resolve billing problems. Patients can also use medical billing advocates to help negotiate payment options with healthcare providers and insurance companies.

It can be challenging to navigate the world of healthcare billing, but it doesn’t have to be. Working with medical billing advocates can help you save time and money, decrease stress, and gain expert information and assistance. The medical bill advocacy services offered by CHAFAhelps guide you throughout your entire healthcare journey.