Medicare is a vital healthcare program that provides coverage for millions of Americans. It provides essential healthcare benefits for those over the age of 65, as well as certain younger individuals with particular disabilities.

Enrolling in Medicare, however, can be a complicated process, and many beneficiaries make common errors that can result in insufficient coverage, higher spending, and unnecessary stress.

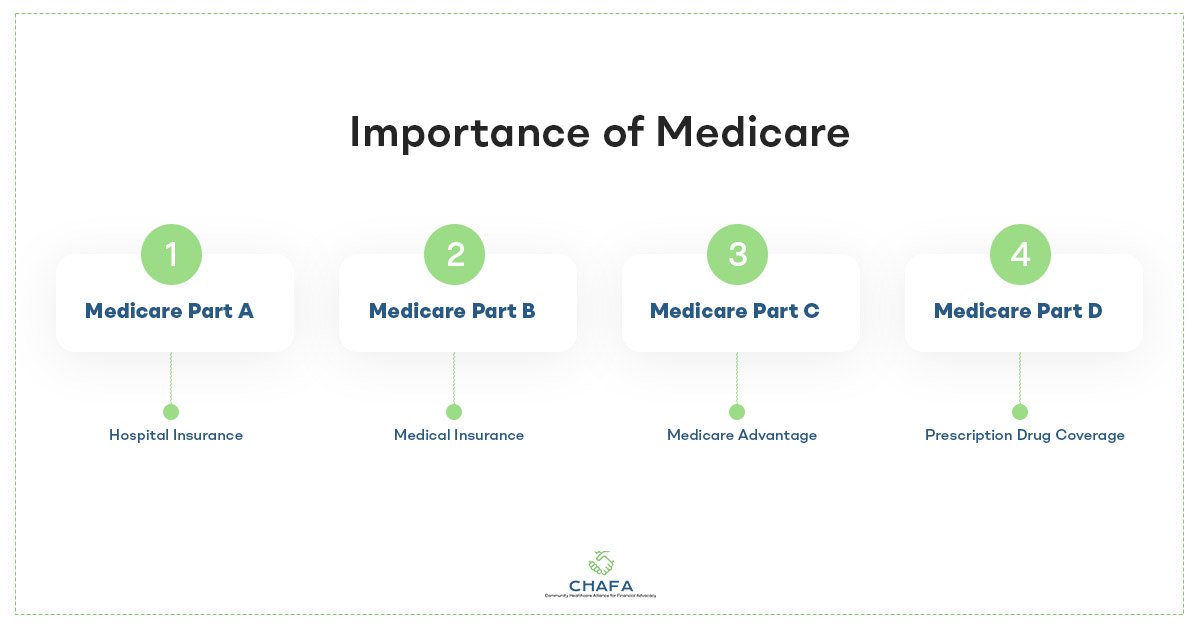

Importance of Medicare

Medicare is structured into different parts, each covering specific healthcare needs:

- Medicare Part A (Hospital Insurance)

- Medicare Part B (Medical Insurance)

- Medicare Part C (Medicare Advantage)

- Medicare Part D (Prescription Drug Coverage)

Medicare ensures that eligible individuals, especially seniors, have access to healthcare services, regardless of their income or pre-existing conditions.

Medicare helps mitigate healthcare costs by covering a substantial portion of healthcare expenses, reducing out-of-pocket costs.

Common Medicare Enrollment Mistakes and Solutions

1) Missing the Initial Enrollment Period (IEP)

The Initial Enrollment Period (IEP) is the first chance for most people to sign up for Medicare. It normally lasts seven months, commencing three months before your 65th birthday and ending three months after. One of the most common mistakes is failing to capitalize on this window of opportunity.

Solution: Make a note of it on your calendar and plan ahead of time. Prepare your schedule well in advance to avoid missing the IEP. Start preparing for Medicare enrollment at least three months before you turn 65. This will give you more time to gather information, make informed decisions, and submit your application effectively.

2) Not Signing Up for Medicare Part B

Medicare is split into two parts: Part A covers hospital insurance and Part B covers medical services. Some people erroneously believe they only require Part A and postpone or skip enrolling in Part B. As a result, critical medical services could turn out inaccessible.

Solution: To prevent making this mistake, enroll in both Medicare Part A and Part B during your IEP. This broad coverage will give you access to a wide range of healthcare services, such as doctor visits, preventive care, and medical equipment. Doing it early on will also prevent any complications in the future.

3) Forgetting to Sign Up for Medicare Part D

Prescription drug coverage is provided under Medicare Part D. Many people disregard the significance of Part D and fail to enroll during their IEP. This can result in significant out-of-pocket expenses for prescription drugs.

Solution: Consider your medication requirements and sign up for Part D early on. To avoid making this error, evaluate your current prescription medicine requirements and select a Part D plan that covers them. If you do not enroll in Part D during your IEP, you are going to incur late enrollment penalties. During the Open Enrollment Period each year, review your plan to make sure it still suits your needs.

4) Assuming Medicare Is Free

For most people who have worked and paid Medicare taxes for at least ten years, Medicare Part A usually comes free of charge. Some individuals, however, erroneously believe that all aspects of Medicare are free. In actuality, Medicare Part B and Part D have monthly premiums, as well as deductibles and coinsurance.

Solution: To avoid this misunderstanding, plan ahead for Medicare costs. Learn about the costs involved with each component of Medicare. Make a budget for these costs so you can organize your finances accordingly. Consider Medicaid, Extra Help, or Medicare Savings Programmes if you need help covering Medicare expenditures.

5) Overlooking Medigap Insurance

Medicare does not cover all healthcare costs. Many people overlook the significance of Medigap (Medicare Supplement) insurance. Without it, you could face massive personal costs.

Solution: Explore Medigap options to get around this issue. Look into and compare Medigap plans to discover one that fits your demands and works within your budget. Medigap insurance can help with expenses not covered by original Medicare, such as deductibles, copayments, and coinsurance. Enroll in Medigap during the Open Enrollment Period for the best rates and guaranteed acceptance.

6) Ignoring Medicare Advantage Plans

Part C Medicare Advantage plans, which combine Part A and Part B benefits into a single plan, provide an alternative to Original Medicare. A lot of people ignore these options and stick with Original Medicare, possibly foregoing significant benefits.

Solution: Consider the perks of Medicare Advantage. Don’t make the mistake of ignoring Medicare Advantage plans. Investigate the plans available in your area, which often come with extra benefits such as dental, vision, and prescription drug coverage. To make an informed decision, weigh the benefits and drawbacks of Original Medicare against Medicare Advantage.

7) Missing the Annual Open Enrollment Period

You can make changes to your Medicare coverage during the Annual Open Enrollment Period, which runs from October 15th to December 7th each year. Many individuals forget to take advantage of this opportunity to examine and change their plans.

Solution: Annually review and adjust your coverage. To prevent making this mistake, make reviewing your Medicare coverage during the Open Enrollment Period a yearly habit. Your medical needs and financial situation could fluctuate and changing your plan can help you save money while receiving more effective care.

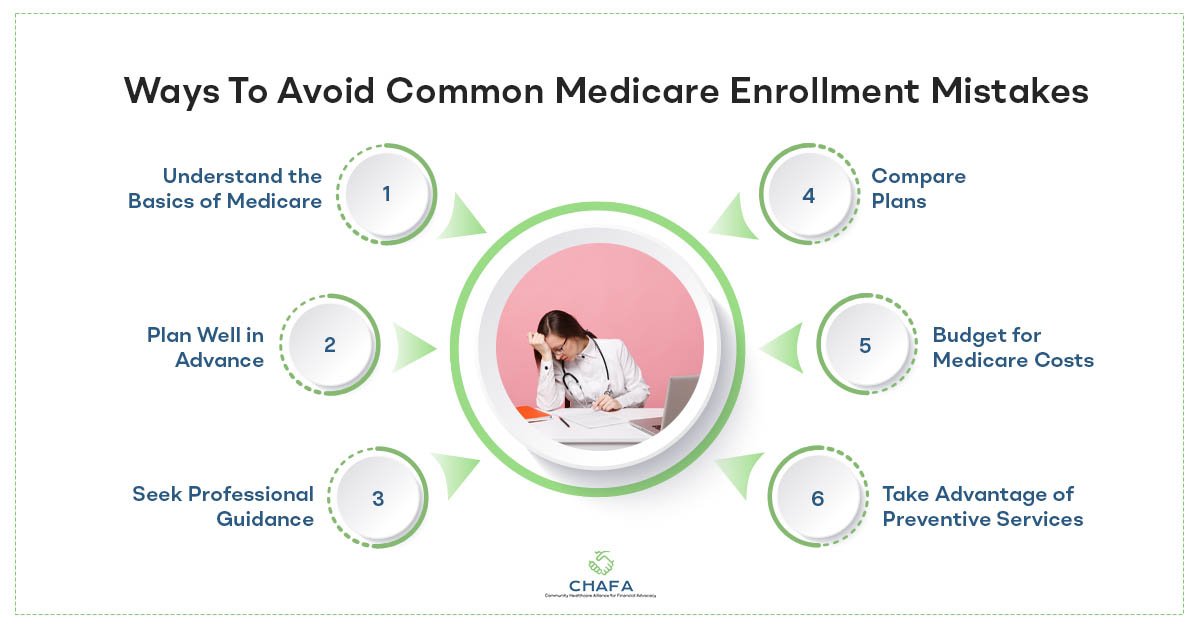

Ways To Avoid Common Medicare Enrollment Mistakes

1) Understand the Basics of Medicare

The first step in avoiding Medicare enrollment mistakes is to educate yourself about the program. Understand the different parts of Medicare (A, B, C, and D) and what they cover.

2) Plan Well in Advance

Start preparing for your Medicare enrollment well before your 65th birthday. Mark your calendar to ensure you don’t miss the Initial Enrollment Period. This advance planning will give you the time you need to gather information, compare plans, and make the right choices.

3) Seek Professional Guidance

Medicare can be complex, and it’s perfectly acceptable to seek guidance from experts. Consider consulting with a Medicare counselor, insurance agent, or a trusted healthcare professional who specializes in senior care.

4) Compare Plans

Medicare offers various plans and options. Don’t rush into a decision without comparing different plans to see which one aligns best with your needs and budget.

5) Budget for Medicare Costs

Understanding the costs associated with Medicare is essential. Consider both the premiums and potential out-of-pocket expenses when budgeting for healthcare in retirement. Make sure you have a financial plan in place to cover these costs.

6) Take Advantage of Preventive Services

Medicare provides coverage for many preventive services, such as vaccinations, screenings, and wellness exams. Take advantage of these services to catch and address potential health issues early, reducing the need for costly treatments down the road.

Enrolling in Medicare is a significant milestone in one’s healthcare journey. By understanding the potential pitfalls and taking proactive steps, you can make informed decisions, save money, and secure the healthcare coverage that suits your unique needs. With the right knowledge and approach, you can navigate the Medicare world successfully.

Contact CHAFA for any Medicare assistance and guidance.