Losing a loved one is an emotionally stressful and overwhelming instance, and the last thing you want to deal with is the burden of complicated medical bills.

However, this is an unfortunate reality for many families, and understanding how to handle these financial duties is essential.

Did you know that approximately 1% of adults owe more than $10,000 in medical debt in the United States?

Understanding Medical Debts

Medical bills do not simply disappear when a person dies. When a person dies with unpaid medical expenses, the bills are considered medical debt after the due date.

This does not, however, imply that your loved ones and descendants are obligated to pay them.

Your estate is responsible for paying your medical bills. This is the total value of all your assets at the time of your death.

In addition to being expensive, medical bills can be complicated, come from numerous providers, and sometimes contradict one another. Therefore, it is important to have someone help with medical bills assistance and ways to assess them.

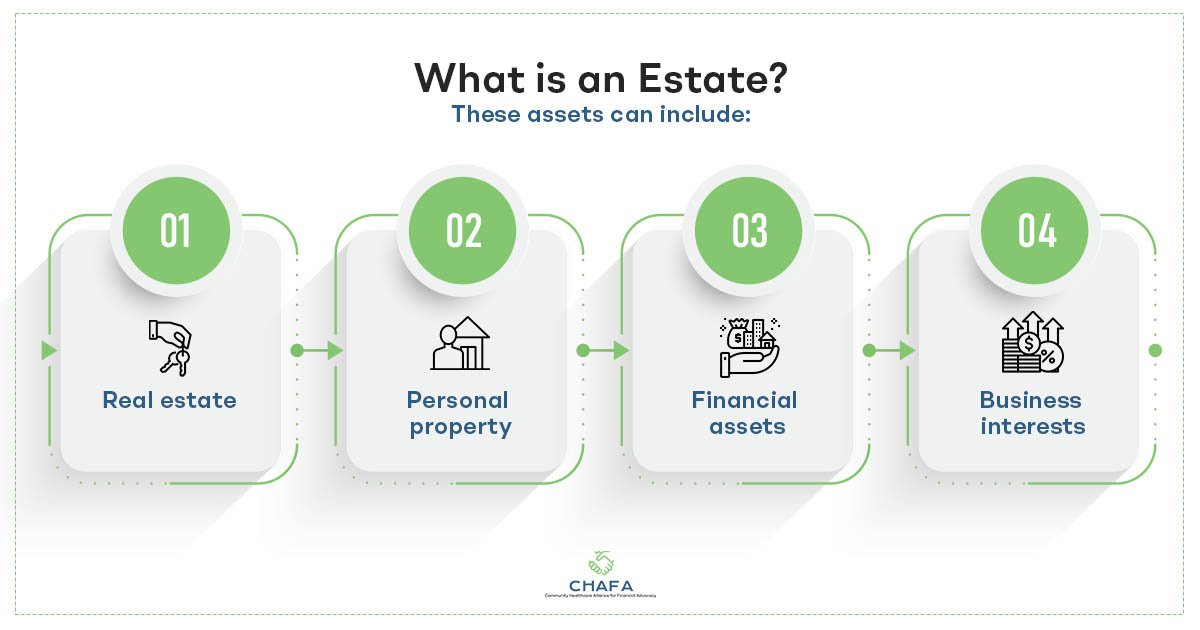

What is an Estate?

Before delving into the specifics of assessing the estate to handle medical bills, it’s essential to understand what an estate is and what it comprises.

An estate is essentially the collective term for all the deceased person’s assets, properties, and debts.

These assets can include:

– Real estate (Homes, land, and other properties)

– Personal property (Vehicles, jewelry, and furniture)

– Financial assets (Bank accounts, investments, and life insurance policies)

– Business interests (Ownership in companies or partnerships)

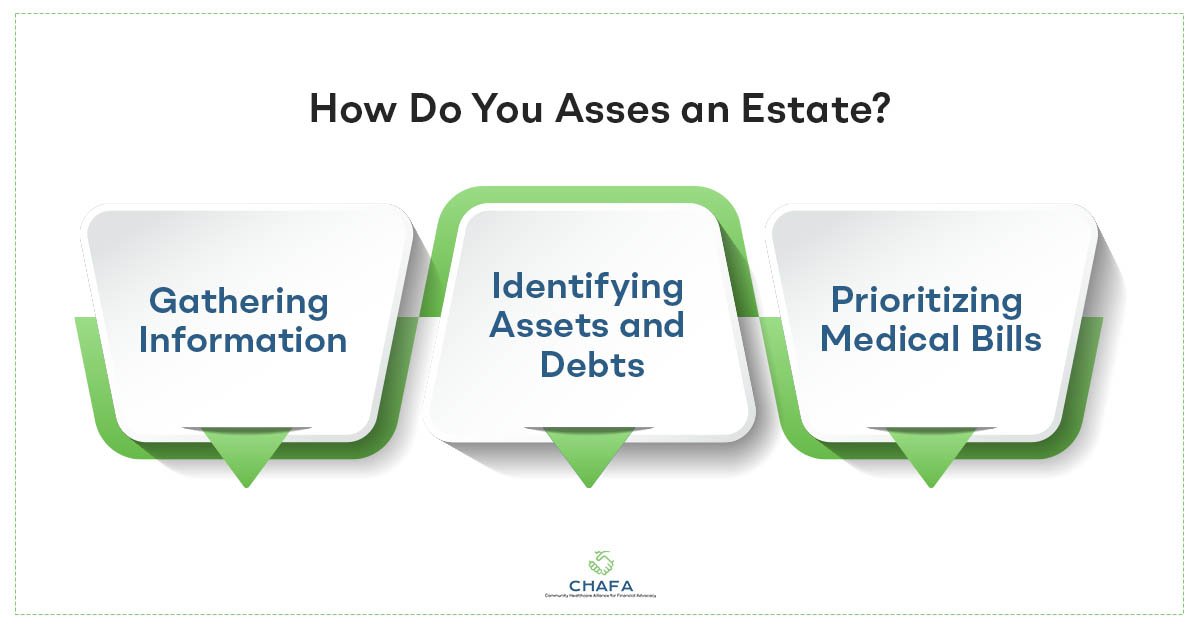

How Do You Asses an Estate?

1) Gathering Information

Gathering all relevant information is the very first step in assessing the estate. Locating important paperwork, financial statements, and legal documents generally falls under this category.

Here’s what you should look for:

- Last Will and Testament: If the deceased had a will, it should specify their wishes for the distribution of their assets.

- Financial Statements: Collect bank statements, investment account information, and any information related to debts and outstanding bills.

- Life Insurance Policies: Check for any life insurance policies that can help with medical bills assistance.

- Property Documents: Gather deeds, titles, and other documents related to real estate and personal property.

- Retirement Accounts: Determine if the deceased had any retirement accounts, such as 401(k)s or IRAs. Also check for beneficiaries.

2) Identifying Assets and Debts

Once you’ve gathered all of the relevant documents, it’s time to determine the estate’s assets and debts. This stage entails compiling a detailed inventory of everything the deceased owned and owed.

Here’s what you should do:

- Make a list of all the assets, including their estimated values. This should cover real estate, personal property, financial accounts, and any business interests.

- Create a list of debts, which can include mortgages, loans, credit card balances, and medical bills.

3) Prioritizing Medical Bills

With the assets and debts data at hand, it’s essential to prioritize medical bills in the estate assessment. Medical costs can be significant, and failing to treat them correctly can result in financial difficulties for surviving family members.

- Review the Bills

- Identify Insurance Coverage

- Prioritize Uncovered Expenses

What is the Estate Executor’s Role?

If the person who passed away left a will, they most likely named an executor to handle the estate. The executor is the one responsible for assessing and distributing assets as well as settling obligations, including medical costs.

The executor needs to firstly obtain legal authority to act on behalf of the estate, often through a process known as probate.

The next step would be to notify creditors, including medical service providers, of the death and provide them with the necessary documentation to support the claims.

The estate executor is then expected to examine all claims from medical service providers to ensure their accuracy and legitimacy.

If the estate’s assets are not sufficient to cover all debts, the executor may need to negotiate with creditors to establish manageable repayment plans or seek reductions in the outstanding balances.

Once all debts, including medical bills, are addressed, the executor can distribute the remaining assets according to the deceased’s wishes as outlined in the will.

Estate’s Liability for Medical Bills

It’s important to note that the estate is liable for the deceased individual’s medical bills. However, the estate’s liability is limited to the value of the assets it contains. In other words, the estate is responsible for paying off medical bills only up to the extent of the assets available. If the estate does not have sufficient assets to cover all the debts, including medical bills, it may be declared insolvent.

Insolvency and Its Implications

When an estate is declared insolvent, it signifies that its debts outweigh its assets’ worth.

In such circumstances, asset distribution is often prioritized based on legal obligations, with medical expenditures receiving a lower priority than secured debts such as mortgages or other legally necessary payments.

The implications of insolvency on medical bills can include:

– Medical service providers may not receive the full payment they are owed.

– Surviving family members are generally not personally responsible for covering the remaining medical bills once the estate is declared insolvent.

It’s essential to consult with an attorney who specializes in estate law to navigate insolvency and its implications effectively.

Additionally, negotiating with medical service providers to minimize the amount owing may be possible in some situations. Medical providers are frequently eager to assist families in difficult financial situations, and they may be willing to set up payment plans or reduce the total sum.

Seek Legal Advice

Navigating the assessment of an estate and managing medical bills can be a complex and legally intricate process. Therefore, it’s highly advisable to seek legal advice from a medical bills attorney, especially if you are dealing with a substantial estate or complex financial situations. This is where CHAFA Helps comes in, to guide you through this complicated terrain.

With the right help you ensure compliance of state and federal laws, along with protection of family assets.